Sustainability Approach

Board Statement

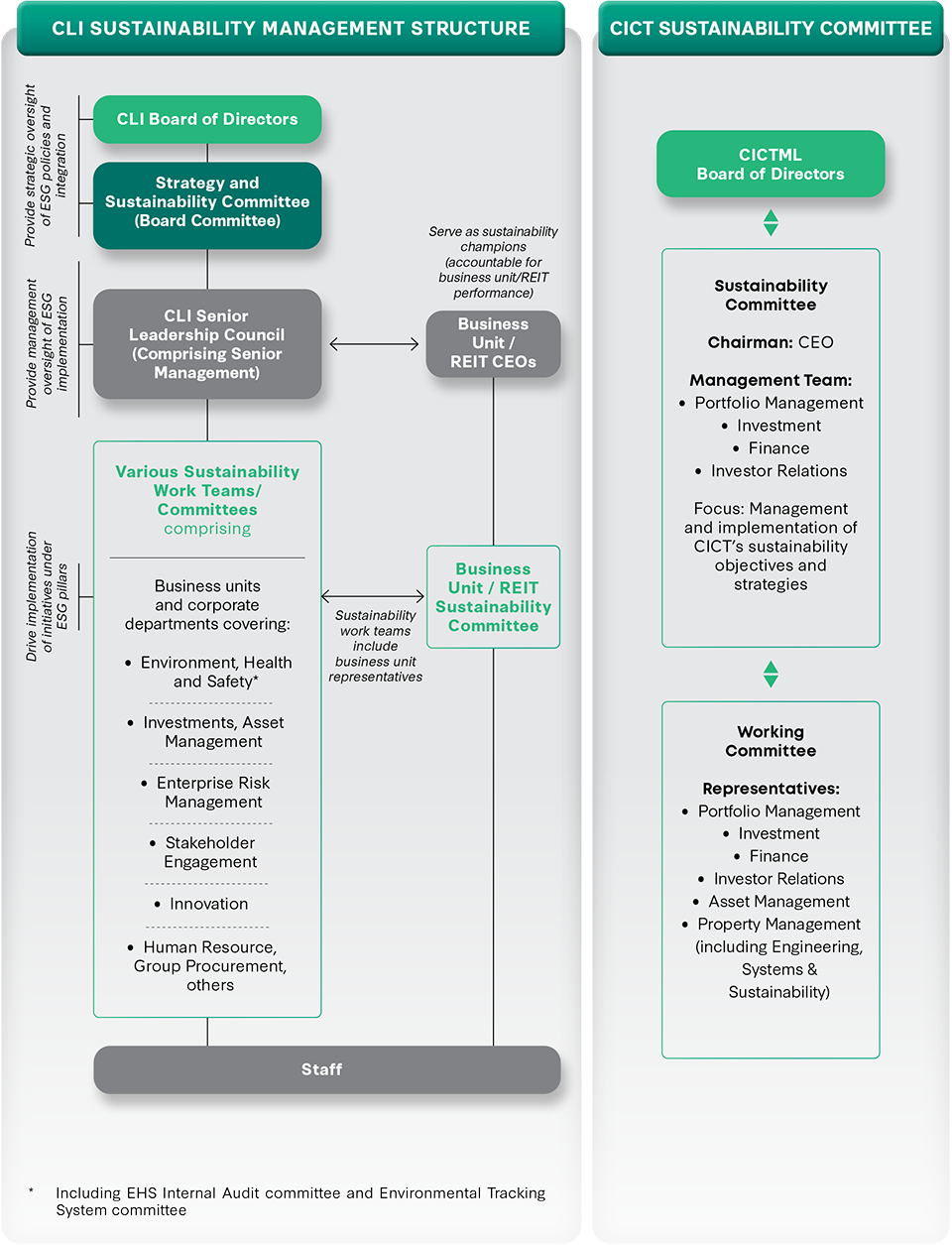

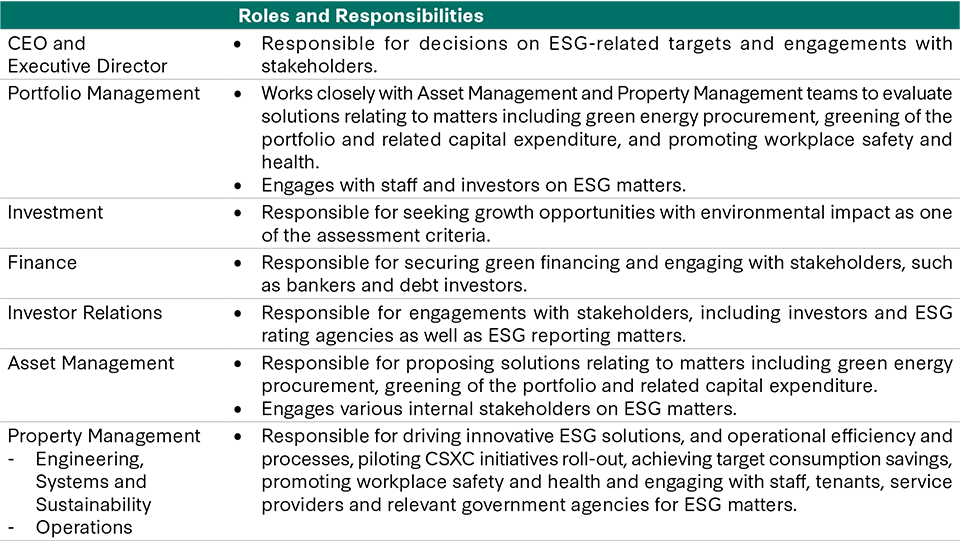

At CICT, sustainability is at the core of everything we do. We are committed to growing in a responsible manner, delivering long-term economic value, and contributing to the environmental and social well-being of our communities. The operations of CICT’s properties are managed by the property managers (which mainly comprise subsidiaries of CLI), in accordance with the property management agreements. The material ESG factors have been identified with set targets for 2030, considering CICT’s business focus and in alignment with the CLI 2030 SMP. Advancing towards a common set of goals, the CICTML Board has reviewed and endorsed the material ESG factors put up by the management team.

CICT’s ESG plan and targets steer our efforts on a common course to maximise impact through building portfolio resilience and resource efficiency, enabling thriving and future-adaptive communities, and stewarding responsible business conduct and governance.

The CICTML Board is responsible for overseeing the CICT’s sustainability efforts and takes these ESG factors into consideration when determining its strategic direction and priorities. The CICTML Board also approves the executive compensation framework based on the principle of linking pay to performance. The Manager’s business plans are translated to both quantitative and qualitative performance targets, including sustainable corporate practices.

Our sustainability performance has consistently been well-regarded by global indices such as FTSE4Good Index Series. The Manager will continue to identify and adopt meaningful ESG practices and enhance sustainability in the real estate sector.

CICT aligns its sustainability goals with CLI to achieve the sustainable performance of its portfolio. Both CICTML and the property managers oversee CICT's business and operations, ensuring adherence to CLI's sustainability framework, policies, and guidelines, including its ethics and business conduct code. The 2030 SMP, which is reviewed every two years, guides CICT’s sustainability efforts across the ESG pillars. This enables CICT to create a greater positive impact on both the environment and communities.

Based on CLI's revised 2030 SMP, the SBTi-approved targets for scope 1 and 2 emissions are in line with a 1.5 °C trajectory. The commitment to achieve Net Zero emissions by 2050 for scope 1 and 2 is reaffirmed, with an increased emphasis on social indicators. For each of the three ESG pillars and their respective focus areas, CLI has identified specific pathways to achieve the sustainability objectives and will adapt its strategies as technologies evolve and new scientific data becomes available.

Aligned with CLI’s refreshed 2030 SMP framework and targets, CICT is committed to reducing its absolute scope 1 and 2 emissions by 46% by 2030, using 2019 as the baseline year. In addition, CICT aims to achieve Net Zero for its scope 1 and 2 emissions by 2050.

This ambitious commitment aligns with the global effort to limit the temperature increase to below 1.5°C. Roadmaps and plans are devised to achieve CICT's sustainability objectives.

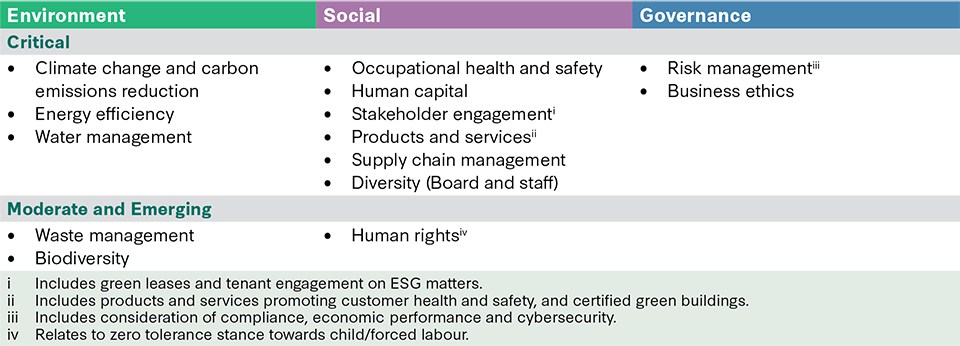

CICTML Board endorses the material ESG issues that are most relevant and significant to CICT and its stakeholders. A double materiality approach is adopted, considering issues which are material from either the impact or financial1 perspectives, or both.

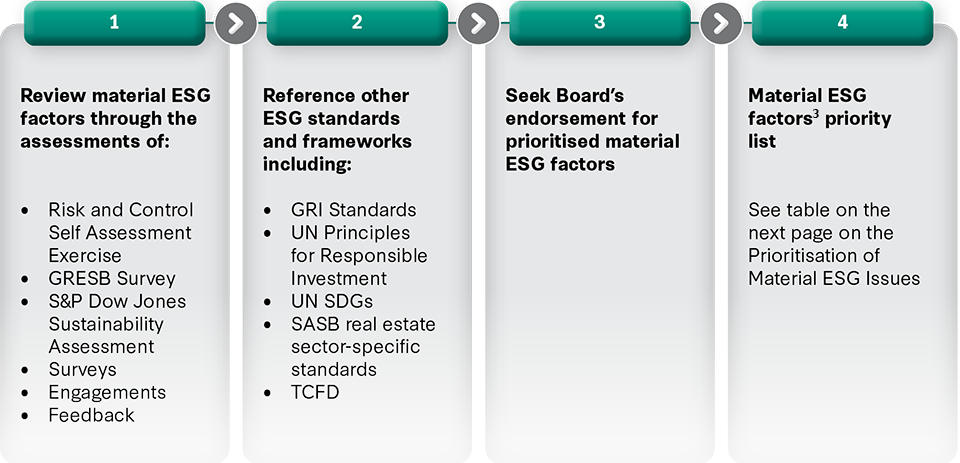

Potentially material ESG issues arising from activities across CICT and CLI’s value chain (including potential risks and opportunities in the immediate and longer term) are primarily identified via ongoing engagement with the CICT team, CLI's BUs and external stakeholders, as well as reviews of sources including investor questionnaires, and ESG surveys, benchmarks, frameworks such as GRESB and SASB.

In addition, CICT has a regular review, assessment and feedback process in relation to ESG topics. Identified material issues are reported in a corporate risk register through the annual group-wide Risk and Control Self-Assessment (RCSA) exercise2, which identifies, assesses and documents material risks and the corresponding internal controls to manage those risks. These material risks include fraud and corruption, environmental (e.g. climate change), health and safety, and human capital risks which are ESG-relevant. Identified material ESG issues are then prioritised based on the likelihood and their potential impact on CICT's business continuity. For external stakeholders, priority is given to issues important to the community and applicable to CICT and CLI. In FY 2023, the ESG material topics were endorsed by CICTML Board for their continued relevance. For more details, please refer to the Material Topics and Boundaries section of the SR 2023.

Regular Review, Assessment and Feedback Process for Material ESG Factors

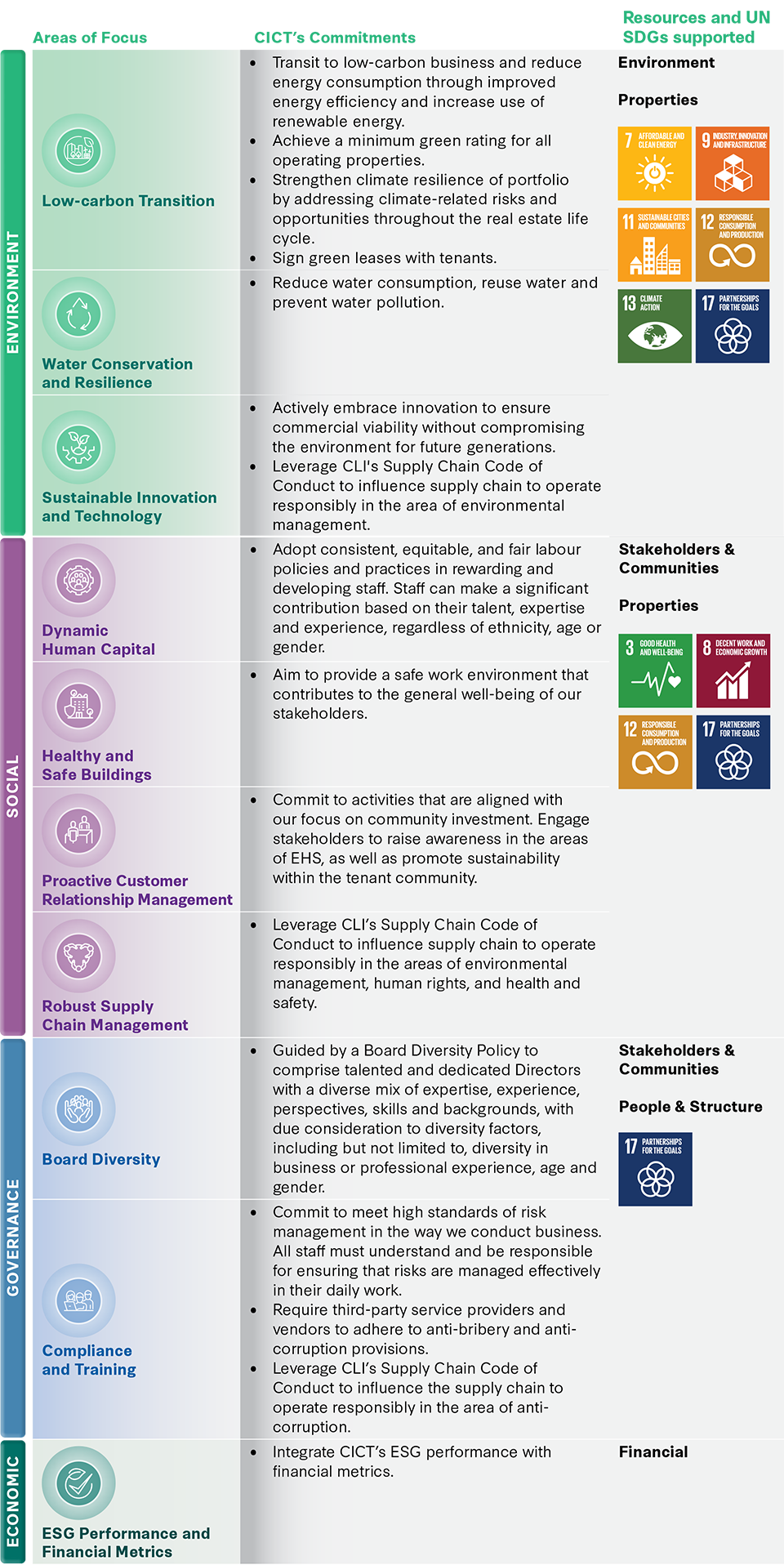

CREATING VALUE AND ALIGNMENT TO UNITED NATIONS SUSTAINABLE DEVELOPMENT GOALS (UN SDGS)

CICT-endorsed material ESG issues, along with the value created, adhere to the 2030 SMP focus areas and commitments. These are mapped to CICT’s resources, which include Financial, People and Structure, Properties, Environment, and Stakeholders and Communities. They are also aligned with the eight UN SDGs that closely match the 2030 SMP focus areas, where CICT can make the most significant positive impact.

The UN SDGs call on companies everywhere to advance sustainable development through the investments they make, the solutions they develop, and the business practices they adopt. In doing so, the goals encourage companies to reduce their negative impacts while enhancing their positive contributions to the sustainable development agenda.

The material topics and boundaries are summarised here.