Portfolio Overview

Properties

26

Portfolio Property Value1

US$18.4 billion

S$24.5 billion

Steady Operating Metrics YoY

Portfolio Committed

Occupancy2

Occupancy2

97.3%

1.5 ppts

Portfolio

Property Value

Property Value

S$24.5

billion

billion

1.2%

Portfolio

Property Value

Property Value

3.4 years

0.3 years

FY 2023

Rent Reversion3

Rent Reversion3

Retail Portfolio

8.5%

Office Portfolio

9.0%

Retail Portfolio

FY 2023

FY 2023

Tenant Sales4

1.8%

Shopper Traffic5

8.6%

Occupancy

Cost

Cost

16.3%

0.3 ppts

Retail Portfolio Information

Retail Occupancy Rate2,6

98.5%

Retail Weighted Average Lease to Expiry6,7

2.0 Years

Office Portfolio Information

Office Occupancy Rate6

96.7%

Office Weighted Average Lease Expiry6,7

3.4 Years

Integrated Development Portfolio Information

Integrated Development

Occupancy rate

Occupancy rate

98.5%

Integrated Development Weighted Average

Lease to Expiry7

Lease to Expiry7

4.9 Years

Notes:

1

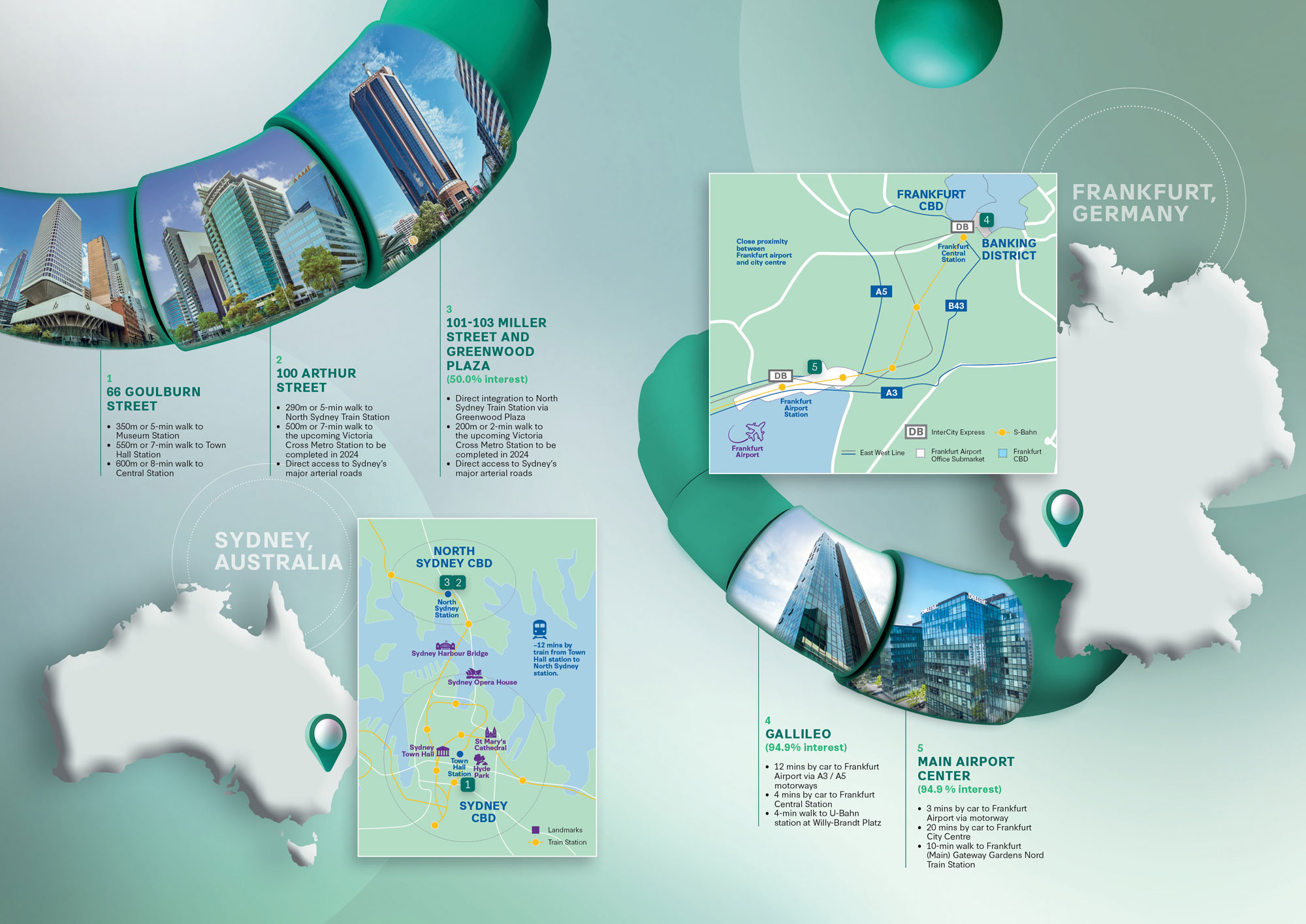

Portfolio property value as at 31 December 2023. Includes CICT’s proportionate interest in Gallileo and Main Airport Center (94.9% respectively), CapitaSky (70.0%), CapitaSpring (45.0%) and 101-103 Miller Street & Greenwood Plaza (50.0%).

2

Includes CQ @ Clarke Quay as major AEI works have been completed.

3

Based on average committed rents for incoming leases versus average rents of expiring leases of Singapore portfolio.

4

Compared against FY 2022 tenant sales on a per square foot (psf ) basis and adjusted for non-trading days.

5

Compared against FY 2022 shopper traffic.

6

Retail comprises retail-only properties and the retail component in integrated developments (except Greenwood Plaza which is a small retail component) and office comprises office-only properties and the office component in integrated developments.

7

WALE is based on monthly gross rental income and excludes gross turnover rents as at 31 December 2023.

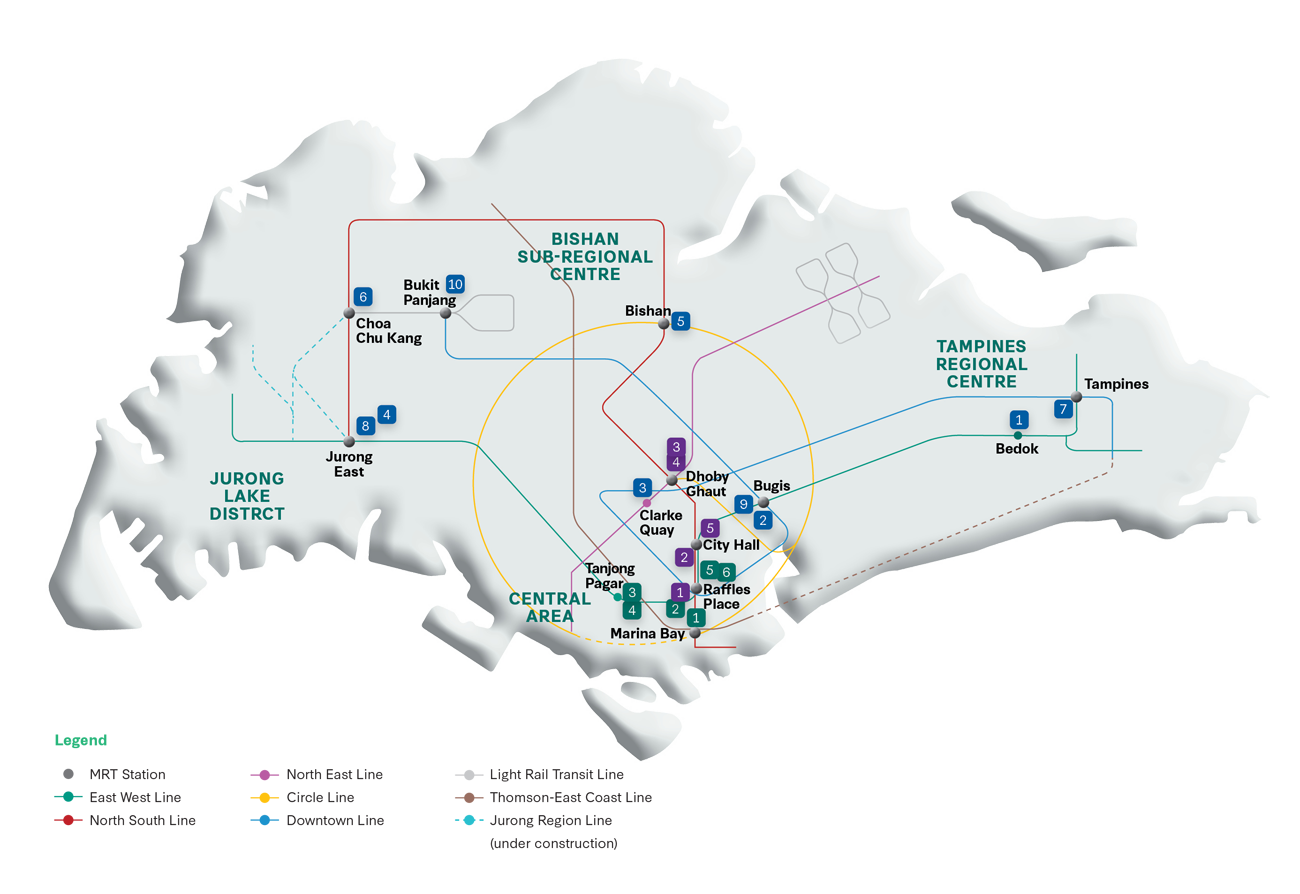

SINGAPORE

Integrated Developments

2

Office

Retail

OVERSEAS PROPERTIES